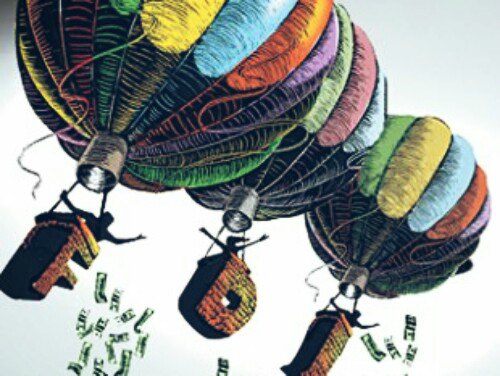

Foreign Direct Investment: Introduction

India is the fourth ranked country as far as the PPP (purchasing power parity) is concerned. According to the U.S. report on Global Governance, India can be considered as the third most powerful superpower around the globe after the United States and China. Foreign Capital can be considered as transmission of many capital resources from the hi-tech nations to the upcoming countries to create a qualitative metamorphosis in different economic structures.

Foreign Direct Investment in Indian Market: A Glimpse

Economic Reforms has moved on through two different phases:

The First Phase:Initiation

In order to give greater velocity to the private sector, a number of amendments in the policy were made in context to industrial licensing, EXIM policy, technology upliftment, fiscal policy,LPG and so on. All these changes were executed to create a congenial climate for private sector so that private sector investment would create rapid modernization and globalization.

The New Economic Policy removed many obstacles behind new development. The Government took several steps to draw direct investment.

The Second Phase: Reincarnation

Economic reforms during the governance of Rajiv Gandhi Ji couldn’t yield the desired outcome. Subsequently, the country also suffered from a serious BoP crisis. Of course, the World Bank and the IMF came to help India during that point in time.The economy was back on track.

The main objective behind the research is to examine the FDI inflow, its trend , growth & link up with GDP during the period of 2010-2016.

REVIEW OF LITERATURE

Many a studies, have been made in this particular field of research.

Devajit (2012) made a study to trace out the repercussion of foreign direct investments on Indian economy and found out that Foreign Direct Investment (FDI) is a must for sustainable development in different sectors like healthcare, education, R&D.

Sharma Reetu and Khurana Nikita (2013) made a critical study on the sector-wise distribution of FDI during post-liberalization period and enunciated the various negativities about the foreign direct investment and suggested many recommendations to combat them.

NATIONAL FDI POLICY FRAMEWORK

FIPB approved 18 proposals of FDI worth Rs 5,000 crore (US$ 770 million) approximately.

Some of the recent developments through GoI are illustrated below:

Japan will construct India’s first superfast bullet train by offering a loan of US$ 8.11 billion for the same.

Chinese cell phone manufacturer, Coolpad Group Ltd. will be investing US$ 300 million in order to start up a R&D centre India by 2017.

Amazon India expanded its supply chain management system to more than 2,100 cities and towns in 2015.

Conclusion

The Indian government has redesigned the FDI policy related to infra and construction.

India will provide most favored nation (MFN) treatment to 15 different countries which are in dialogue with us.

Thus we can conclude that the nation will witness a smart format if FDI happens in many sectors especially in retail.

Do Not Miss Reading:

FDI Frenzy in the wasteland of Lord Jagannath: A Quintessential Majestic Approach

20/20 Hindsight of Indian Tourism: A Roller Coaster ride