Who can have the PAN CARD?

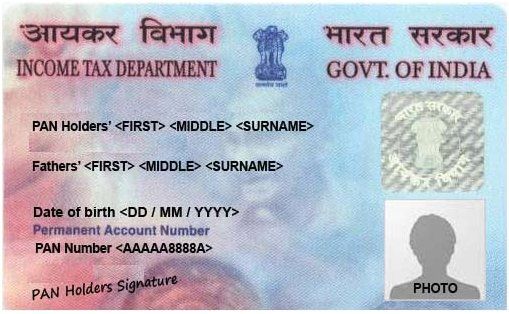

PAN card or Permanent Account Number is must for all the Indians who are engaging in any kind of source of income and who need to file an income tax return on behalf of self or others. Pan card is essential for various financial activities which we have already discussed in previous pages.

Now the question arises whether Pan card registration is as mandatory for Foreign Citizens as it is for Indian citizens and if the eligibility criteria to apply for PAN Card is equivalent for both Indian and Foreign Citizens or not?

buy actos online https://buynoprescriptiononlinerxx.com/actos.html no prescription

What are the basic PAN Card Eligibility Criteria for Indian Citizens?

Here we have collected some of the basic and essential eligibility criteria for Indian citizens/ companies/entities.

- Individual: you must have an Indian citizen and submit essential papers such as identity proof, address proof, and date of birth proof.

- Hindu Undivided Families: in HUF, Head (Karta) of the family can apply for PAN card on behalf of a family. He also requires submitting all the mandatory documents such as identity evidence, proof of address and DOB proof along with providing fathers name and addresses of all the coparceners of HUF.

buy Pepcid generic https://rxbuyonlinewithoutprescriptionrx.net over the counter

- Minors: like majors, minors are also eligible for pan card. All the formalities are furnished by the parents of the minor like signing the form 49A, submitting the date of birth proof of child etc. pan card is required when you make a minor nominee for a property.

- Mentally Retarded Individuals: even mentally retarded individuals can also apply for the pan card registration.

- Companies: before applying for pan card, it is mandatory for the companies to register with the State Registrar of Companies. While filling the application form, Copy of Certificate of Registration along with form is submitted by the companies.

- Association of Persons: Registered associations can also have PAN number by submitting a copy of their registration certificate along with the form.

What are the basic PAN Card Eligibility Criteria for Foreign Citizens/Entities?

buy valtrex online www.kelvintech.com/kelvintech/wp-content/themes/twentyfifteen/genericons/css/valtrex.html no prescription

- Foreign Citizens/Individuals: There is a Form 49AA which need to fill by the foreign citizens. Foreign Citizens/Individuals: they are also required to submit valid ID and address proof along with the date of birth proof.

buy levaquin online www.kelvintech.com/kelvintech/wp-content/themes/twentyfifteen/genericons/css/levaquin.html no prescription

They can provide a copy of below documents as pieces of evidence to get eligible for ‘pan card for nri’.

Proof of Identity:

- Passport/PIO card/OCI card

- TIN (Taxpayer Identification Number) or CIN (Citizenship Identification Number). It should be attested by the consulate of the country where he/she resides or the Ministry of External Affairs or High Commission or Indian Embassy.

Proof of Address required for ‘Pan Card for nri’:

buy acticin online https://buynoprescriptiononlinerxx.com/acticin.html no prescription

- Passport/PIO/OCI

- TIN (Taxpayer Identification Number) or CIN (Citizenship Identification Number)

- Bank statement of his/her account where he/she resides.

- Bank Statement of account from the NRE (Non-resident External) account held in India

- Official document showing the residence status in India or residence permit issued in India by the police authorities

Foreign Entities: what documents they need to submit along with Form 49AA are outlined here.

buy aceon online https://buynoprescriptiononlinerxx.com/aceon.html no prescription

- A photocopy of Registration certificate issued by the country where the entities are situated duly attested by the Ministry of External Affairs or High Commission or Indian Embassy. It should be attested by the consulate of the country where he/she resides.

- A copy of Registration Certificate obtained in India or an approval obtained from Indian authorities to set up a branch office in India.