Every year in India, 6,00,000 people die due to Cancer (Source: Indian Express | July 26, 2016) and in every 33 seconds, Heart Attack kills a person. (Source: TOI | May 19,2016). Fit or not, when it comes to critical illnesses nobody is secure. Since, Life follows no fixed plan, these illnesses not just drain your body but also your savings – leaving you highly stressed physically as well as mentally.

This is the reason why Bajaj Allianz Life Insurance has launched its eTouch Online Term – A regular premium payment, pure term and health cover plan.

Features of Bajaj Allianz Life eTouch Online Term and Health Cover Plan:

Comprehensive Protection for #IfsOfLife

The eTouch Online term by Bajaj Allianz Life provides comprehensive protection to cover total disability, accidental death, critical illnesses and death.

The Pure Term Insurance Plan Covers 34 Critical Illnesses

Life is full of Ifs, but if you plan and be ready to face it, you won’t be regretful, but safe. This is the reason why Bajaj Allianz Life eTouch Online Term and health cover plan covers as much as 34 critical illnesses including Cancer, Lung Disease, Heart Attack, Loss of Limbs, Brain Tumour, Bone Marrow Transplant, Blindness, Poliomyelitis, Major Burns, Loss of Speech and even Coma of Specified severity.

eTouch Online Term and WOP Inbuilt Rider

One of the key advantages of eTouch is it’s inbuilt waiver of premium benefit on occurrence of Accidental Total Permanent Disability or Critical Illness.

5 Claim Settlement Benefit Options

Option to receive policy proceeds in five ways:

- 100% as lump sum

- 100% as level monthly installment

- 100% as increasing monthly installment

- 50% as lump sum and remaining in level monthly installment

- 50% as lump sum and remaining in increasing monthly installment.

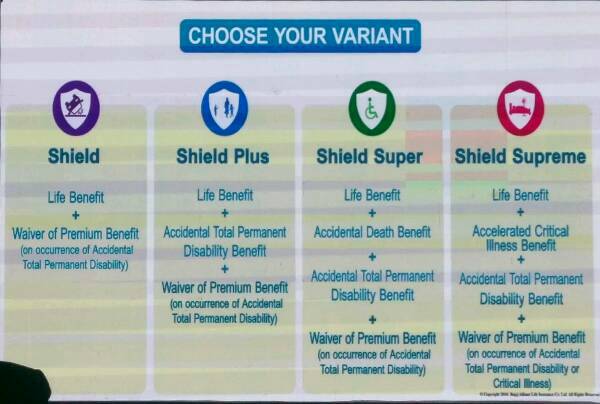

4 Product Variants to Choose From:

- Shield – Life + Waiver of Premium Benefit (on occurrence of Accidental Total Permanent Disability.

- Shield Plus – Life + Accidental Total Permanent Disability + Waiver of Premium Benefit (on occurrence of Accidental Total Permanent Disability.)

- Shield Super – Life + Accidental Death Benefit + Accidental Total Permanent Disability + Waiver of Premium Benefit (on occurrence of Accidental Total Permanent Disability.)

- Shield Supreme – Life + Accelerated Critical Illness.+ Accidental Death Benefit + Accidental Total Permanent Disability + Waiver of Premium Benefit (on occurrence of Accidental Total Permanent Disability or Critical Illness.)

Benefits of Bajaj Allianz Life eTouch Online Term and health cover plan:

- Competitive Premium Rates

- Lower premium for leading healthy lifestyle for non-tobacco users

- Maximum age at maturity – 75 years

- A person aged 25 years chooses Bajaj Allianz Life eTouch Shield with a policy term of 30 years and a sum assured of Rs. 1 crore. He pays an annual premium of Rs. 6,642 after a HSAR of Rs. 1,287 which is only Rs. 18 per day.

- If a person aged 35 years with Bajaj Allianz Life eTouch Shield Supreme is diagnosed with Critical Illness, he will receive Rs. 75,00,000 (75% of sum assured), the future premiums are waived under the policy, and the policy continues with all its remaining benefits.

- If a person aged 45 years with Bajaj Allianz Life eTouch Shield Supreme meets with an accident and suffers a total permanent disability, he gets Rs. 2 crores (an additional sum assured as Accidental Total Permanent Disability benefit) and the policy continues with all its remaining benefits. If the person dies an unfortunate death, his nominee gets Rs. 2,25,00,000 (Sum assured on death minus the ACI benefit paid) and the policy terminates.

Claim Settlements at Bajaj Allianz Life for FY 2015-16

- Total Value of Claims paid – Rs. 8,38,90,00,000

- Total Number of Claims Settled – 1,65,244

- Total Claim Settlement Ratio – 98.07%

- Average Turnaround Time – 8 Days

Life Hai ‘If’ se Bhari…Fikar Na Kar, Plan Kar #JioBefikar.

For details and information SMS LIFE to 56070 or call the toll free no. 1800 209 7272