The Government of India in its Budget Speech 2015 announced three Jan Suraksha schemes i.e. Social Security Schemes relating to the Insurance and Pension Sectors. The three schemes, Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY) and the Atal Pension Yojana (APY) is launched mainly to cover the underprivileged working in the unorganized sector.

Here we share everything you wanted to know about the schemes

buy revatio online https://buywithoutprescriptionrxonline.com/revatio.html no prescription

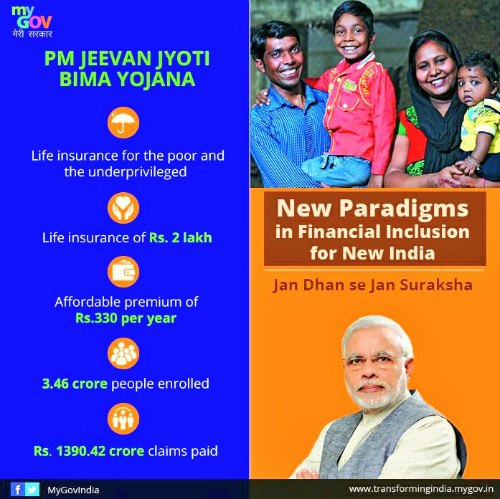

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)?

The Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) is yearly life insurance plan that covers any type of death due to any reason. The plan can be renewed every year and is accessible to people of India in the age group of 18 to 50 years (life cover up to age 55) having a savings account.

Under PMJJBY scheme, life cover of Rs. 2 lakh is available for a period of one year stretching at a premium of Rs.330/- per annum from 1st June to 31st May. It is offered via LIC and other Life Insurance companies. The premium gets debited from the account holder’s account through the auto debit facility. (For more info – Pradhan Mantri Jeevan Jyoti Bima Yojana)

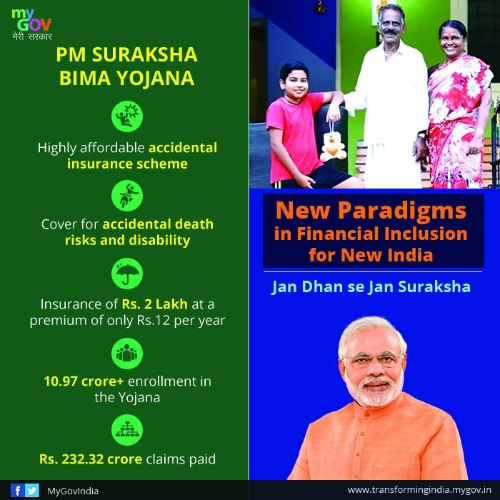

Pradhan Mantri Suraksha Bima Yojana (PMSBY)?

The Pradhan Mantri Suraksha Bima Yojana (PMJJBY) is an accident insurance scheme that covers accident at a premium of only Rs.12 per year. This Jan Suraksha Scheme is available to people of India in the age group 18 to 70 years having a savings account.

Under PMSBY scheme, risk coverage is Rs. 2 lakh for accidental death and Rs. 1 lakh for permanent total disability for a period of one year stretching from 1st June to 31st May. It is offered by Public Sector General Insurance Companies and/or any other General Insurance Company who are willing to offer the product on similar terms. The premium gets debited from the account holder’s account through an auto debit facility. (For more info – Pradhan Mantri Suraksha Bima Yojana)

Atal Pension Yojana (APY)

The Atal Pension Yojana (APY) is a pension scheme for the unorganized sector and is open to all bank account holders. Under the scheme, subscribers can pay Rs. 1000, Rs. 2000, Rs. 3,000, Rs. 4,000 or Rs, 5000 per month. The Central Government co-contribute 50% of the total contribution or Rs. 1000 per annum, whichever is lower for a period of 5 years from the financial year 2015- 16 to 2019-20. The minimum age for joining the scheme is 18 and the maximum age of joining the scheme is 40.

buy renova online https://buywithoutprescriptionrxonline.com/renova.html no prescription

Any subscriber joining the plan of Rs. 1,000 monthly pension at the age of 40 years would be required to contribute Rs. 291 every month. However, if a subscriber joins at the age of 18 years, he will contribute only Rs. 42 every month. Likewise, a subscriber joining the plan of Rs. 5,000 monthly pension at the age of 40 years would be required to contribute Rs. 1,454 every month. However, if a subscriber joins at the age of 18, he will contribute only Rs. 210 every month.

buy singulair online https://buywithoutprescriptionrxonline.com/singulair.html no prescription

Depending upon the subscribers’ contribution, the subscribers would then at the age of 60 will then receive the fixed minimum pension of Rs. 1000 per month, Rs. 2000 per month, Rs. 3000 per month, Rs. 4000 per month, Rs. 5000 per month depending on their contributions, which is based on the age of joining the Atal Pension Yojana (APY). (For more info – Atal Pension Yojana)

Infographic Courtesy: Transforming India

There are the three Jan Suraksha schemes launched by the Government of India to cover the unorganized sector