Many SME businesses in India need access to credit at one point in their operations. Although this is clear to different lending institutions, it still doesn’t make getting loans for business any easier. Technology has come to revolutionise different areas including lending and borrowing.

Now, you can get these loans online and hassle-free. There are a number of advantages when you take business loans online. These include:

Now, you can get these loans online and hassle-free. There are a number of advantages when you take business loans online. These include:

Tailored Business Loans

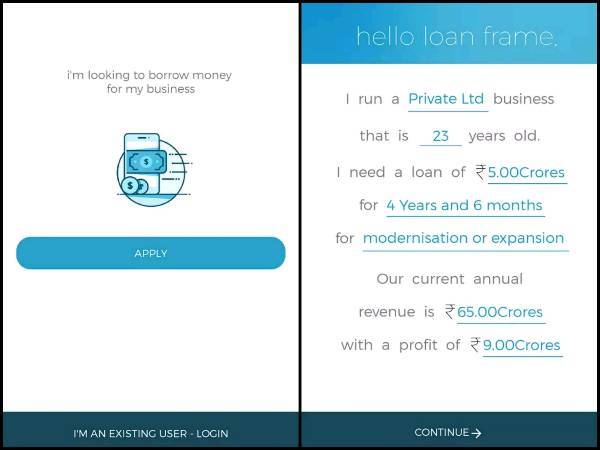

When you get an online business loan, you also get a chance to have the loan tailor-made for your needs. Whenever you physically go to a financial institution to get capital finance, you are only presented with off-the-shelf options. These institutions have specific products that are on offer, and the terms are rigid and cast in stone.

However, Loan Frame does not offer the same restrictions. Different lenders post competitive bids that are structured according to your business needs.

Unsecured Loans and More Options

SME Businesses in India are used to the same old options from financial institutions when it comes to lending. These options are few and limited. However, online business loans provide a variety of options for your business.

Through Loan Frame, you can get access to equipment loans, a line of credit for businesses, capital financing and unsecured loans among others. You will be able to check through the type of loan that suits you and choose the option.

Another option you can look at is speaking to the best money lender in Singapore who may also be able to help assist guide or help you. When looking at business loans you want to ensure you have covered every option before making a final decision.

Easier Loans for Business Applications

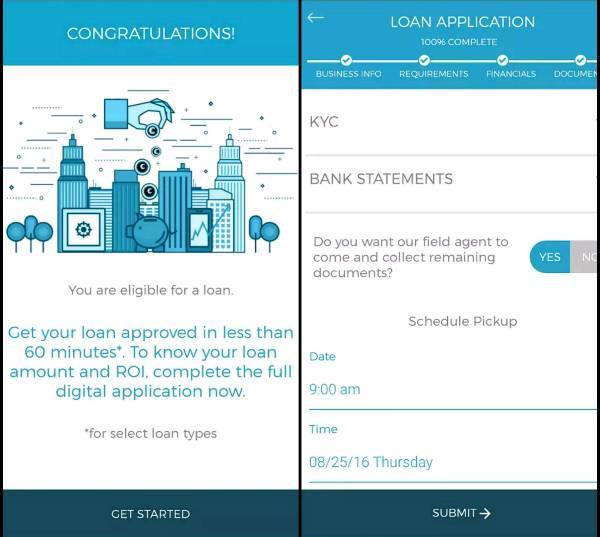

Whenever you apply for a business loan online, you do not have to go through a number of hoops to get to the point where you actually submit an application for the loan. Physically going to a lending institution will require you to fill out many forms, submit documentation and go through a whole process.

A Loan Frame application is much easier and simpler. The straightforward process also helps to save up on your valuable time. Furthermore, you can find out whether or not you will be getting the loan in a short period of time which allows you to explore different alternatives for your capital finance.

Cheaper and Faster

Lending institutions include overhead costs and other business running costs in their interest rates while Loan Frame does not factor in the same fees. This automatically makes online business loans much cheaper. The repayment rates are then lower and thus more manageable for any budding SME business in India. In addition to lower repayment rates, these online loan applications are faster. You do not have to wait for someone to confirm all the hardcopy paperwork before they can review your eligibility and inform you about whether or not you will be getting the loan.

The online process is fast and generates a verdict in a short period of time. This also means that the loan gets to you faster, so your plans for the business are not delayed.

Getting loans for business can be a tough process for SME businesses in India. However, if you opt for an online application through Loan Frame, the process does not have to be as gruelling. It is easier, cheaper, and faster and provides more options which is convenient for all businesses.

Before you go ahead with taking out a loan, I would still recommend you to discuss your options with a financial adviser like 7Wealth. There are plenty of different businesses out there that can give you financial advice, so this is just an example of a business that would be able to help you out. Most business can provide you with advice on the most suitable option for you, so it is definitely worth considering. If you have already spoken to you adviser and they have recommended a loan, go for it!