Ola is making quite some noise both on ground and social media. From Bhavish Agarwal challenging Google Map with Ola Map, bringing all that nationalism and now coming up with Ola Electric IPO. With the debacle of PayTM and other startups in the market many are wondering whether to subscribe Ola Electric IPO or give it a miss. Now, if you too are wondering, what if this turns out to be Zomato or give me some listing gains, you must read this post carefully

So, What Is the Company Ola Electric Mobility Limited All About?

Founded in 2017, Ola Electric Mobility Limited is an electric vehicle company. It mainly manufactures electric vehicles (EVs) and core components like battery packs, motors, and vehicle frames at the Ola Futurefactory.

Since August 2021, the company has launched 7 new products and announced 4 more. The Ola S1 Pro in December 2021 and then Ola S1, Ola S1 Air, Ola S1 X, and Ola S1 X+ in subsequent years.

On August 15, 2023, the company announced new EV models and motorcycles like Diamondhead, Adventure, Roadster, and Cruiser.

As of October 31, 2023, the company operates its “omnichannel distribution network” in India, which includes 870 experience centers and 431 service centers

In FY 2023, around 75% of the company’s two-wheeler exports from India were to Africa, LATAM, and Southeast Asia, with limited domestic supply.

What is the IPO Objectives of Ola Electric IPO?

- Repayment or Pre-payment of Indebtedness

- Expenditure for Organic Growth Initiatives

- General Corporate Expenses

- Capital Expenditure

- Investment in Research and Product Development

Also Read: What is Front Running in Stock Market?

Financial Overview

As a startup, Ola Electric Mobility Limited’s revenue increased by 88.42% from March 31, 2023, to March 31, 2024, while the profit after tax (PAT) dropped by -7.63%. The total Borrowing has increased from 38.87 crore in 2021 to Rs 2,389.21 crore till March 31, 2024. Profit after tax is negative still. It has transpired from -199.23 crores to -1584.40 as on March 31, 2024.

Key Performance Indicators

- Market Capitalization: Rs 33,521.75 Cr

- RoNW: -78.46%

- P/BV: 13.72

| KPI | Values |

| EPS (Rs) Pre IPO | -4.3 |

| EPS (Rs) Post IPO | -3.59 |

| P/E (x) Pre IPO | -17.69 |

| P/E (x) Post IPO | -21.16 |

A negative Price-to-Earnings (P/E) ratio means the company is currently losing money, indicating financial distress, an unprofitable business, and investment risk.

Peer Comparison

| Company Name | EPS (Basic) | EPS (Diluted) | NAV (per share) (Rs) | P/E (x) | RoNW (%) | P/BV Ratio | Financial statements |

| Ola Electric Mobility | -4.35 | -4.35 | 5.54 | -78.46 | Consolidated | ||

| TVS Motor Company Ltd. | 35.50 | 35.50 | 158.10 | 69.69 | 23.68 | 15.49 | Consolidated |

| Eicher Motors Ltd. | 146.18 | 145.92 | 659.06 | 36.78 | 22.17 | 7.44 | Consolidated |

| Bajaj Auto Ltd. | 272.70 | 272.70 | 1,037.41 | 29.95 | 26.61 | 9.38 | Consolidated |

| Hero Motocorp Ltd. | 187.36 | 187.04 | 892.08 | 27.16 | 20.98 | 6.06 | Consolidated |

Ola’s financial standing doesn’t seem favorable in peer comparison.

Ola Electric IPO Details

- IPO Date: August 2, 2024, to August 6, 2024

- Listing Date: [TBD]

- Face Value: ₹10 per share

- Price Band: ₹72 to ₹76 per share

- Lot Size: 195 Shares

- Total Issue Size: 808,626,207 shares (aggregating up to ₹6,145.56 Cr)

- Fresh Issue: 723,684,210 shares (aggregating up to ₹5,500.00 Cr)

- Offer for Sale: 84,941,997 shares of ₹10 (aggregating up to ₹645.56 Cr)

In this Ola Electric IPO, ₹645.56 crore worth of shares are offered for sale, indicating promoters might be looking to exit.

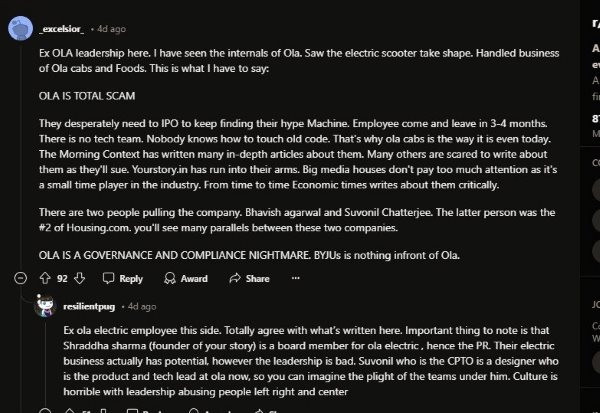

Here’s What People are Saying on Reddit About Ola Electric Company

Remember Nikola Motors, which tried to become a cheaper version of Tesla?

At one point, its valuation surpassed Ford Motors without producing a single vehicle. Later, it was revealed that their technology was fake, and their “demos” were just fancy CGI. Startups’ valuation games can be confusing, and sometimes it feels like they are measuring nothing substantial.

Beware of IPOs that might seem attractive for listing gains but can end up like PayTM. Retail investors should avoid such IPOs. Strong fundamentals are essential in the market; hence, taking unnecessary risks isn’t advisable.

Retail investors might still oversubscribe, promoters could sell their shares, and we might end up posting on social media asking what to do with a worthless investment.

Why hasn’t Ola launched its main IPO and is now launching an Electric IPO instead?

Remember, in 2017, Mr. Bhavish Aggarwal promised profitability in two years, but the company reported massive losses for several years.

Nishant Mittal in his LinkedIn post mentions

In 2020, Mr. Aggarwal again claimed Ola was “profitable,” showing “operating profit” just before attempting to launch an IPO. However, the market cooled, and it took almost two years to reveal FY22 financials, showing ₹1,522 Cr loss on ₹1,970 Cr revenue. By the time FY23 results were due, the focus shifted to Ola Electric, and the old “Ola is very profitable” routine was dropped. Now, as the IPO market heats up, Ola Cabs is talking about “profitability,” “electrification,” and “premiumization” to attract retail markets, despite cumulative losses of nearly ₹21,000 Cr.

Ola raised about $5B in its 14-year journey, but that doesn’t mean it’s worth $5B. Recently, an investor (Vanguard) marked down Ola’s valuation from $7.2B to $1.9B. And even that seems high because, on a macro level, cab aggregation at this scale in India hasn’t been profitable and likely won’t be. This was always obvious to sensible people, but some distorted the market. In this dynamic, Ola is especially vulnerable.

Thus, promoters chose the Ola Electric route instead of Ola Cabs. Now it’s up to retail investors to decide whether to jump into this, hoping for listing gains.

Be cautious and alert, as the Ola Electric IPO might bring more trouble than benefit! Meanwhile MapMyIndia has sued Ola Map alleging copy of data. Full story coming soon.