In recent developments, Paytm has found itself in a tight spot, facing stringent actions from the Reserve Bank of India (RBI). According to a recent circular, RBI has imposed restrictions on Paytm Payments Bank under section 35A of the Banking Regulation Act, 1949, preventing them from accepting fresh deposits or engaging in credit transactions beyond February 29.

So, what does this mean for Paytm Bank users?

Essentially, from that date forward, users won’t be able to add funds to their wallets, prepaid instruments, FASTags, or National Common Mobility Cards. In practical terms, all account holders are required to deplete their balances and close their accounts. This move is poised to impact a significant user base, including 300 million wallets, 30 million bank accounts, 1.6 billion UPI transactions per month, and eight million Fastags associated with Paytm Bank.

Also Read: 10 Things PayTM Customer Should Know about RBI’s Action on PayTM w.e.f February 2024

Why Did RBI Impose Restrictions on Paytm Payments Bank?

According to the RBI, an external audit has revealed non-compliance with regulations and notable supervisory concerns regarding Paytm’s financial practices. This scrutiny dates back to March 2022 when RBI restricted Paytm Bank from onboarding new customers and mandated thorough audits of its IT systems.

The core issue seems to revolve around the close connection between Paytm and Paytm Payments Bank. Despite being distinct entities, their deep integration has raised concerns for the RBI.

Paytm, or One 97 Communications, holds a 49% stake in Paytm Payments Bank, with the remaining 51% owned by Vijay Shekhar Sharma, according to the company’s 2022-23 annual report. Paytm Payments Bank covers various services such as wallets, UPI, utility bill payments, and deposit accounts.

The integration of these entities is apparent in several aspects, with Paytm Payments Bank accessible exclusively through the Paytm app. Additionally, all Paytm wallet accounts and UPI handles are housed within Paytm Payments Bank.

As a response, RBI has directed One97 Communications Ltd (ONCL) and Paytm Payments Service Ltd to promptly terminate their nodal accounts with the bank.

Is There Any China Angle? Security Threat Related Issue?

Well, as of August 2023, Alibaba’s unit Ant Financial held a 23.8% stake in PayTM, while Mr. Sharma’s stake was only 19.42%. Later, in an offline deal, Ant transferred a 10.3% stake to Mr. Sharma in exchange for convertible debentures. Following this transaction, Ant’s stake in PayTM stood at 13.5%. Before the listing, Ant had a 24.9% stake, and Alibaba had a 6.3% stake.

Jairam Ramesh raised concerns about the facade of Paytm Payment Bank on the microblogging platform X. He questioned why a company with Chinese connections, which at one point had over 31% Chinese ownership and more than ₹7000 crore in Chinese investment, and had faced RBI penalties for noncompliance in 2022, was not placed under tighter monitoring.

Now, the question arises whether the RBI could see any security threats due to Chinese ownership of this app?

What are the Consequences of RBI Ban on Paytm Bank?

The impact on Paytm’s annual operational profit is anticipated to be substantial, ranging between ₹300-500 crore. This projection stems from the hindrance users will face in adding money to their wallets, FASTags, and other services due to the RBI’s directive.

Another concern for RBI is Paytm Postpaid, a buy-now-pay-later (BNPL) service for retail users. While Payments Banks are restricted from offering loans, Paytm’s collaboration with other lenders for BNPL services has raised eyebrows.

Looking ahead, Paytm is under pressure to safeguard its business, particularly its UPI operations, holding a 13% market share for both merchants and consumers. Users with the @paytm handle on the Paytm app won’t be able to make UPI transactions, even if their UPI IDs are linked to a different bank account.

Offline merchants on the app are also grappling with challenges. Most of Paytm’s merchants have their accounts with Paytm Payments Bank. To address this, Paytm needs to not only change the nodal account to another bank but also update bank account information for its 37 million merchants. Failure to do so in time may result in merchants not receiving transferred money, and their Paytm QR codes being replaced.

The recent notifications have led Bernstein Research to express a negative outlook, stating that, “For all practical purposes, the above notifications end the operations of Paytm Payments Bank.”

As per the National Payments Corporation of India’s mandate, high-volume payment apps, known as TPAPs, must partner with at least three banks. Finding banks to accommodate its volumes and get their systems ready in less than a month poses a significant challenge.

What Lies Ahead?

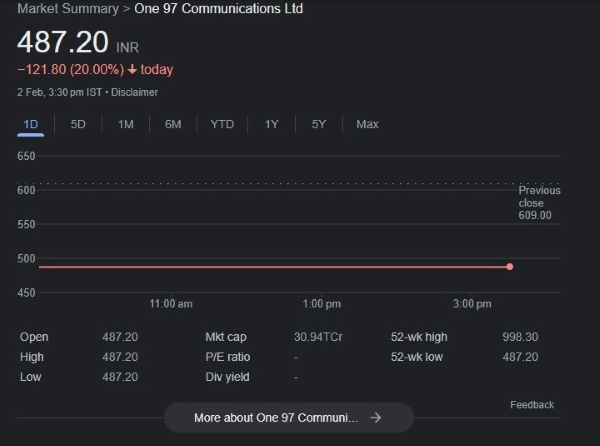

The road ahead appears challenging for Paytm, with expectations of a sharp downturn in its stock due to several revenue streams halting following the RBI’s directive. Customer migration to competitors may pose challenges for Paytm even after regulatory matters are resolved. However, panic selling at this stage wouldn’t be a wise decision.

This summarizes the recent developments surrounding Paytm and the challenges it faces in the foreseeable future.