From its inception, State Bank of India was one of the most friendly banks of the common man of India. Except the staff, everything about the bank was well-disposed. Favorable facilities, no hidden charges, absolute clean plans, easy to use amenities – making it the best bank to open any account in India.

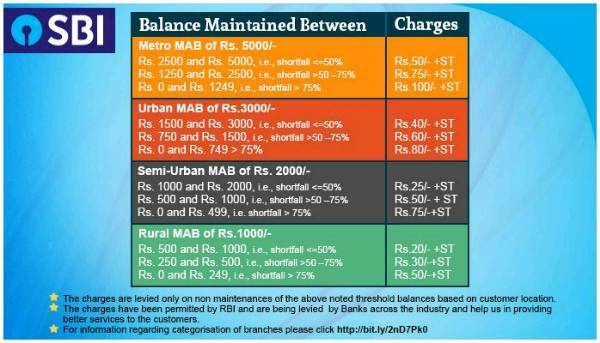

However, nobody knew the bank would hit its loyal patrons with a tight slap by imposing new set of rules starting from the minimum monthly average balance rule. A person who maintained zero balance account will now have to maintain 5,000 if his account falls in metro, 3,000 if his account is in Urban Area, 2000 in case it is a Semi-Urban area and 1,000 for accounts in the rural area.

A regular review of your account will help you to ensure the average monthly balance is maintained and avoid the minimal charges. pic.twitter.com/bZSwWRW134

— State Bank of India (@TheOfficialSBI) April 22, 2017

Now, post the bombardment of this rule, I’m maintaining minimum balance of Rs. 5,000 for two of my accounts. While, one is SBI savings account, the other is Bank of India current account. Shocked? Well that’s the good thing about other Public sector banks, they allow you to open and maintain current account at Rs. 5,000.

Besides, the minimum monthly average balance of most of the banks for saving accounts is either Rs. 500 or Rs. 1000, so why would anybody prefer State Bank of India in the urban or metropolitan area? What is SBI doing extra that these banks are not doing or cannot do?

This lowers the liquidity in a common man’s hand especially the people with lower salary living in metropolitan areas. What does SBI want? That the common man who could find solace in it’s umbrella till date, should now go find a shelter under the private sector banks who are nothing less than leeches?

In addition, according to a recent circular on the website of SBI, customers with a Basic Savings Bank Deposit will get four free withdrawals (including ATM) in a month, after which withdrawals will be charged at Rs 50 plus service tax at any SBI branch and at Rs 20 plus service tax at other bank ATMS.

In our country where maximum of the farmer’s account in rural areas are in State Bank of India, these set of rules hit the public very hard. What is the Center giving out the indication by these new anti-people rules?

It is a known fact that India’s largest public sector bank is going through huge financial crisis, but these new rules that have been imposed on the common man to help the corporates is highly outrageous.