Adani Shares are the Salman Khan of the Dalal Street. No matter how bad the performance, the reputation, or the loss somehow the shares make it big on the indexes while most of the traders, investors, and analysts remain clueless. Although intraday traders, positional traders, and short-term traders might even book profits, long-term investors are often left questioning the rise and fall of Adani stocks. If you too are wondering why Adani shares are rising in 2022, here are the answers –

Why Adani Shares are Rising in 2022? Commodity Prices are High

Amidst the Russian-Ukraine war, commodity prices went higher and higher. Now, that most of the Adani group of companies somehow or the other are either directly or indirectly linked to commodity, the share prices of the Adani group started rising too.

While, Adani Wilmar (edible oil, Soya, etc) went from its IPO price of Rs. 230 to 850+ in less than 3 months, Adani Power went from 99 to 283 in less than 4 months’ time and so did Adani Enterprises (from 1717 to 2,337) and Adani Ports. The rise in commodity prices somehow made traders and investors bet their money on Adani groups.

Although other commodity-related stocks saw ups and downs, these Adani stocks simply broke their higher highs.

There is a Strange Optimism in the Market When it Comes to Adani Shares

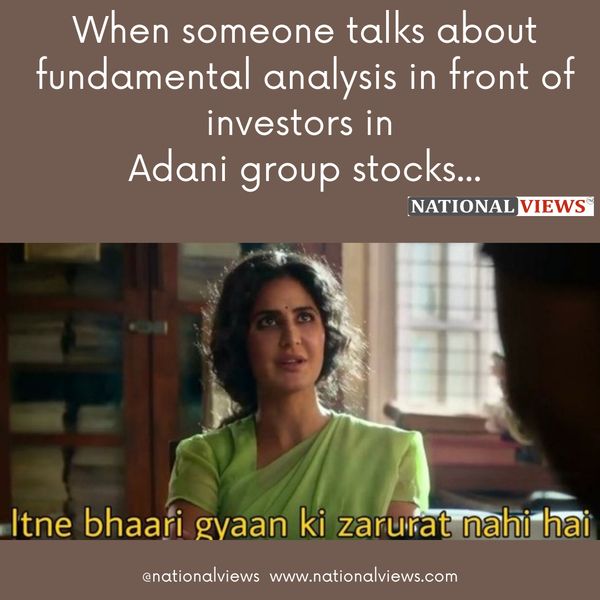

Often when Adani shares grow, they shoot up crazily; and when this happens different types of traders start buying them ignoring the technical and fundamentals. Even when they are in the overbought zone, have a ridiculous PE ratio and a high PB ratio of 7-8 (which means they are 7 to 8 times high of their justified value), people tend to buy.

There is a strange rather weird optimism in the market at such times when it comes to Adani shares. However, traders forget that if a stock can go crazily high in a go without any downfall, it can come down too at the same speed (free falling).

People Seem to Have a Certain Belief that Adani Group of Companies Have Huge Support

Whether the Adani group of companies has the support of the Government or not, there is a wide perception and belief amongst the people of India that till the Central Government of India is that of the current regime and Narendra Modi remains the PM of India, both, Gautam Adani and Adani shares will rise and nothing can come in between Adani group and it’s rise. Any stock market forums, social media groups, and general discussion will lead you to this ‘thought’.

Should you Buy Adani Stocks in 2022?

In order to buy any stocks in the stock market, it is always advised to check on the fundamentals and technical. Only if the fundamentals and techniques are suitable, you can make an entry. So, if any Adani stocks seem a perfect fit and are good technically and fundamentally, you can definitely buy them. That’s the thumb rule you need to follow in investing and trading, no matter which shares it is. If it doesn’t fit in the calculation, it is only risking your hard-earned money.

Following the blind trend, buying in an overbought situation and ignoring all the red signals have often brought us, investors, only misery – whether it has been investing in PayTM IPO, Reliance Power (RPOWER), YES BANK, or buying IRCTC at 1100.

So, if you want to earn profits in long-term, short-term, or even in positional trading always go with the fundamentals and technical. No matter what the stock is if you enter at the right time following the charts, the figures, the numbers, and exit too following the same pattern you are going to make good profits always.

Besides, why book profits only once when you can book it all the time.

Also Read: 11 Top Dividend Stocks Whose Dividend Yield Is More than FD Interest Rates

Also Read: Safe Reputed Penny Stocks to Buy in 2022: Some Even Give Good Dividends!