Away from the hustle and bustle, home is a place where we all feel safe and secure from unforeseen events.

But what if some misfortunes happened within the ‘four’ walls of the home? You might be feeling secured in your home but any mishappening can catch you off guard like you might fall from stairs and break your back or get an electric shock from your washing machine or toaster. One might encounter an accident while doing their daily household chores also. After all, accidents come unannounced and strike anyone at any time.

Similarly, you feel secure when you travel in a car which is loaded with safety features, adhere to all traffic rules while driving/walking on the street and are fully aware of all safety instructions and take due precautions to avoid accidents.

buy remdesivir online https://nouvita.co.uk/wp-content/languages/new/uk/remdesivir.html no prescription

However, none of those mentioned steps guarantee complete security from an accident— while climbing the stairs, playing with friends and needless to say, especially when you are on the road.

What is scary is watching your family struggling and managing your medical expenses, if god forbid, if any of these happen to you. So, while you might be thinking that as you are a housewife or travel less, you are unlikely to meet with an accident, here are some of the facts that would break your myth:

| Road Accident Parameters | 2014 | 2015 |

| Total Accidents in India | 4,89,400 | 5,01,423 |

| Total number of persons killed in accidents | 1,39,671 | 1,46,133 |

| Total number of persons injured in accidents | 4,93,474 | 5,00,279 |

Source: Pibphoto.nic.in

Then there are train accidents in which 15,000 people die every year while crossing rail tracks.

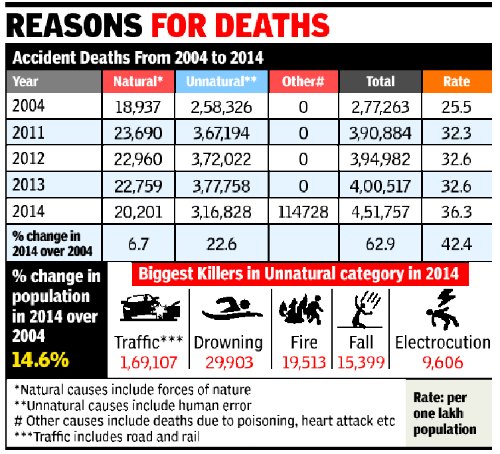

Similarly, natural and unnatural factors also took away deaths as seen in the following:

Source: The Times of India

So, irrespective of your age, gender and profession, it is important to buy a personal accident insurance which offers protection against such misfortunes.

How does a personal accident insurance help?

A personal accident insurance is specifically designed to protect you against any damage caused due to an accident, including partial or complete disability and death. It mainly offers the following benefits:

- Accidental death benefit

- Total permanent disability benefit

- Temporary partial benefit

- Reimbursement of accidental hospitalisation expenses

- Accidental hospital daily allowance

- Additional features like child education, legal benefits, injury arising due to terrorism

In case of your death, your nominee will be entitled to get the insurance money. Unlike a health insurance plan, it is taken on an individual basis and is useful in bridging the gap between a typical life insurance cover and a health cover. Similar to life insurance policy, it makes a payout in case of death of the policyholder and also gives the compensation in case of disability and accident, and thus, helps in riding over medical expenses. This is of great help if one has lots of outstanding debt or EMIs which have to be paid and his/her income is crucial.

Also Read: Know What Your Car Insurance Covers for you and your Family

How is the premium decided?

Unlike other insurance policies, the premium of a personal accident insurance doesn’t depend on the age of the person.

buy zoloft online https://nouvita.co.uk/wp-content/languages/new/uk/zoloft.html no prescription

It is the profession of the person which is considered by insurance companies for deciding the premium. It means a 25-year old airline pilot has to pay a higher premium than a 50-year housewife. Most of the insurers classify professionals on the basis of their risky nature in the following manner:

| Class 1 (Low Risk) | Class 2 (High Risk) | Class 3 (Very High Risk) |

| Teacher | Builders | Pilots |

| Dentist | Veterinary Doctor | Journalists |

| Painter | Manual Labour | People involved in adventurous activities |

How to file a claim in Personal Insurance Policy?

It is important to note that insurers make payment only if accidents occur due to external and violent means. In the case of an accident, the claim process is simple and straightforward and clearly mentioned in the policy document. Some of the documents which may be required to be submitted to the insurer are:

- Duly filled claim form with signature from the policyholder or nominee

- Death or disability certificate as mentioned in the policy

- Attested FIR copy

- Attested post-mortem report, if required

Since the term and conditions of disablement may vary from one insurer to another, it is highly advised to carefully read the policy documents before buying the ‘best fit’ plan.

Also Read: 5 Reasons Why You Must Invest in New India Portfolio by FundsIndia

Tread with caution

In today’s fast paced life, we are vulnerable to a host of uncertainties which can cross our way even when we are sitting comfortably in our drawing room. It is important to give heed to the provision for that unexpected accident that may become fatal and affect you both physically and financially.

Further, personal accident insurance policies can be bought both as a comprehensive plan or rider.

However, it is advised to go for a comprehensive plan which covers various types of accidents, including partial and temporary disability, as against the rider which only covers accidental death and permanent disability. Moreover, you can customise your standalone policy to suit your needs.

Life is unpredictable and in fact, misfortunes happen when you are least prepared for it. So, while you may bank on your life insurance to take care of your family in your absence and health insurance to deal with medical expenses, you have your personal accident insurance policy to rescue you in the case of disability.

Don’t forget to buy one right away so that there is nothing left to chance in your insurance portfolio.