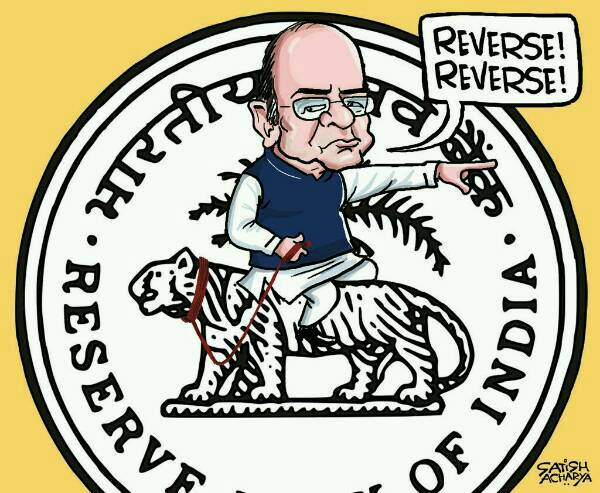

What is the goal set by RBI? Is it really about a ‘cashless’ society as exhorted by our Finance Minister Shri Arun Jaitley?

So, I searched for an answer and got a chance to look at ‘Vision 2018’ – a document by RBI and its wing DPSS (Department of Payments and Systems). Apparently, It talks about “LESS-CASH SOCIETY”. Now spot the difference!

Cashless Society: PM Narendra Modi Exposed

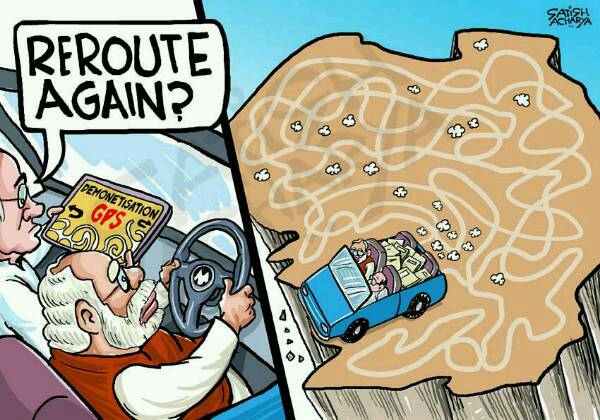

We, the common people got confused along with the media when it came to the lexicons used in this so called “nuclear explosion” now commonly addressed as Demonetization. At the start, it was projected as surgical strike, (wow, what a catching phrase).

Now the question is – Do any surgeon conduct such a major surgery without anesthesia followed by postoperative pain killer? Not at all. If a Charlatan Surgeon abdicated his role, the patient will bleed and die.

Next, lexicon is ‘Black Money‘. All the RBI documents and statements talk about “Fake Currency”. Just think, is it the role of RBI to find Black Money? Not at all, there are systems in place for that mission. IT, CBDT, Revenue Intelligence and many more agencies. RBI’s role is to identify and crush FICN.

Now, come back to the new lexicon “Cashless Society” used to mock every citizen on that perpetual QUEUE. PM Narendra Modi exhorted aam admi to open a/c under PMJDY where it was shown as a tool to eliminate middlemen and send the subsidy in CASH to your accounts.

PM or FM never mentioned the common man about converting them into a new religion of ‘Cashless Society’ but showed them the way to the ATM or Bank where they can withdraw their CASH.

Did Government give smartphones to people to use the so called mobile wallets? Did they put in place POS in shops in villages? Ponder upon it, and introspect. Without such tools and systems in place how can you ask them to abdicate CASH and be a part of the Digital money and CASHLESS SOCIETY?

Can you wag your magic wand at 8.30 pm in the night on a national TV channel and address the populace to convert India from a CASH BASED economy to CASHLESS SOCIETY?

After that announcement, the troll army unleashed its “Whatsapp Narayanastra” questioning and mocking people that why don’t they convert to this new religion?

Let us now examine the systems in place with this context to ensure the new religion of the so called “Cashless Society” by looking at some of the old solid data.

India’s Cash Crisis Is Here to Stay Beyond PM Modi’s Deadline: Check out the RBI report

Look again at the Currency Notes in circulation

₹12.83 lakh crores (Mar 2014), ₹14.29 lakh crores (March 2015) & ₹16.45 lakh crores (Match 2016), so you see the CASH in circulation recording a growth of 11.8% jump between 2014 & 2015 and a growth of 14.9% between 2015 & 2016.

There may be multiple reasons for the growth. That is for economists to explore and explain. I am using this information for another purpose.

When were these Debit/Credit cards along with POS and Internet banking transactions introduced into the system? Mobile Wallets? OVERNIGHT?? Whether they existed in March 2014? No smartphones in 2014? We were not digitally literate in 2014 and not used these means of transactions?

Why the CASH in the system is still not reducing? Why it’s increasing year after year? But, well, we are not supposed to ask questions especially the logical ones 😉

Black Money: The Great Chaos by PM Narendra Modi & FM Arun Jaitley

JIO EXPOSED. RBI EXPOSED. PM NARENDRA MODI EXPOSED

First of all let’s be clear about ATM. Are your ATM transactions cashless or with cash? Now, look at the number of ATM and its reach – Total ATMs in India – 215039 incl White Label ATMs (WLA) out of which only 40345 (18.7%) are in rural areas.

Metro Centres (Delhi, Mumbai, Chennai, Kolkota, Bangalore & Hyderabad) have 55690 ATMs (26%) and rest 55% are in urban & semi-urban centres.

Maharashtra is leading with 24829 ATMs (11.5%), Look at South 33%, TN – 23728, KAR – 16929, AP – 10456, TGNA – 10036, KER – 9093. Delhi has 9070 ATMs, BIHAR 7675, GUJARAT 11625, HARYANA 6496, MP 9777, PUNJAB 7398, RAJASTHAN 8875, UP 19143.

On Eastern side, West Bengal has 11680 ATM & Orissa 6307. These are 16 States have more than 5000 ATM & 90% ATM are here (193117). Rest 13 states & 7 UT have only 21810 ATM, ie, just 10%. Look at NE, those 7 sister States have 5199 and out of which 3645 are in Assam.

Then we have sufficient ATMs available in Rural India? How skewed was your ATM distribution between Urban & Rural? You have 18.4% ATMs in rural India which is having 68.84% population. Yet we have these slogans, GO CASHLESS, Use mobile wallets. 😉 (Pic 1)

We have Debit Cards around 69.72 crores and credit cards amounts to be 2.59 crores but to do cashless transactions at retail level, there are only 14.44 lakhs POS. Around 20.27 crores debit cards were issued by SBI alone. But if we look at the transactions, you can see that most of them remain redundant.

FY 2015-16 recorded ₹2.4 lakh crores credit card transactions & ₹1.6 lakh crores debit card transactions. Both card together amounts to be ₹4 lakh crores. See how debit cards are redundant in the cashless transactions despite its huge volume compared with credit cards.

Now look at the total card transactions in FY 2013-14 & FY 2014-15 for comparison that is ₹ 2.5 lakh crores and ₹ 3.1 lakh crores respectively. And now compare these card transactions of ₹2.5 lakh crores, ₹3.1 lakh crores and ₹4 lakh crores with cash in circulation.

Don’t compare value of card transactions with currency in circulation by saying card transactions reached 25% of currency in circulation. I leave that area to an economist who is specialised in monetary economics planning to explain it to you as I am not at all competent.??

Why 69.72 crores debit cards did less business transactions than 2.59 crores credit cards? Think and introspect. Simple answer is Majority of debit card holders used it as ATM cards to withdraw CASH & not for cashless transactions like credit cards.

Please understand that drawing CASH from the ATM is not a cashless transaction de facto it’s a cash transaction to meet your routine needs.

Now look at the POS available (which is vital for a CASHLESS retail) – they are only 14.44 lakhs. A brute majority are concentrated in metro cities. Now look at the ultimate prescription called PPIs

(Prepaid Payment Instruments) and the lexicons familiar to us is “Mobile wallets”.

There are 48 PPIs existing today including Mobikwik, Ongo, PhonePe, PayTm, Oxygen etc.

For further understanding read this

https://googleweblight.com/?lite_url=https://m.rbi.org.in/scripts/NotificationUser.aspx?Id%3D8993%26Mode%3D0&ei=II6qV8_z&lc=en-IN&s=1&m=808&host=www.google.co.in&ts=1479402069&sig=AF9Nedk5oUxVXkU51CdHyR5TxSZPTT7mNg#a-B

When searching these PPIs one name struck my eyes and guess who is that? Do have a look to serial No. 54 in this link JIO MONEY 😉

https://m.rbi.org.in/SCRIPTs/PublicationsView.aspx?id=12043

Who is this innocent chap? Who is ready to offer you free 4G SIMs? Traps set for you in his Jio Money net? You were in a queue to get SIM too.

JIO did spread its web offering free voice calls and cheap 4G & phones along with their ambitious plan only to to grab the 100 million customers.

Corruption in India: Politics, Demonetization & Scams!

Look at the amount of business transactions of PPIs in our system, it was ₹8100 crores in 2013-14 but now has grown to ₹48800 crores in 2015-16. So what is Jio Money’s real target?

A pie from this 50K crores shared by 48 PPIs?

₹150 from 100 million customers ₹18K crores annually? Or Reliance Jio has grandeur ambitions? To cut through the Indian Currency in circulation and grab the space occupied by it? WHY? 😉

Whether or not it’s a plan to replace INR in wallet with Jio Money in the guise of free voice calls, Jio ecosystem centers around Jio Money. Wow, what a plan by PM Narendra Modi and Jio Ambani!

How much Reliance Jio Money will benefit from this #DeMonetisation GAME? A mighty ambitious PLAN? Draw your own conclusions and drop it in the comment box below –